Selective ABS residuals may improve your risk/reward trade off in the fixed income portfolio construction process.

Introduction

One of the benefits of the securitized fixed income space is the diversity from which investors can access different sources of cash flow, as well as various structures to reflect their risk/return preferences. In this article, we explore asset-backed security (ABS) residuals, which represent the first loss (equity) tranche of a structured ABS deal. We will describe how ABS residuals function, what type of return and volatility they offer to investors, and how market participants can include ABS residuals in their fixed income portfolio construction process to enhance the portfolio’s risk/return tradeoff.

What Are ABS Residuals?

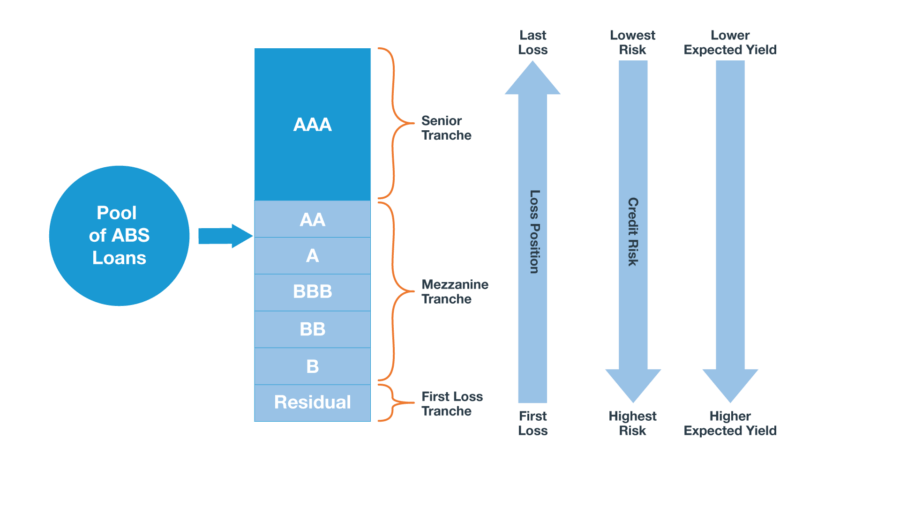

As mentioned, ABS residuals represent the first loss tranche of an ABS deal, meaning the residual will receive cashflow once the other tranches receive principal and interest. Therefore, any and all excess cash flow generated by the deal flows into the residual tranche. This begs the question: what comprises ‘excess cashflow’? Excess cashflow is generated in two ways. One is through overcollateralization, which occurs when the value of the aggregate underlying loans is larger than the debt underwritten in the deal. A simple example is a deal sized at $1 million but backed by underlying collateral worth $1.1 million. The second, and perhaps more prominent source of cash flow, is from what is called excess interest. Excess interest represents the difference between 1) the interest rate of the underlying loans and 2) the average interest rate paid to the individual tranches. In some cases, this difference can be quite meaningful, as the level at which an issuer can fund itself can be very different than the rate for the underlying collateral. For example, if a subprime auto deal pays out an average interest rate of 10% across tranches, and the underlying subprime loan borrowers pay 20% on their loans, the difference of 10% flows to the residual. This 10% figure assumes no underlying defaults, but the residual can still earn meaningful cashflow even if defaults occur.

An Example of an ABS Deal with a Residual Tranche

Source: Thornburg

Not surprisingly, given a residual’s cash flow structure, the yields – or more accurately, the internal rate of return (IRR) – can be extremely attractive. In many base case scenarios, residuals can earn equity-like returns, which no doubt makes them risky investments. That said, ABS residual cash flows were quite solid through the COVID crisis, as underlying borrowers remained largely resilient and continued servicing debt payments.

The Role of ABS Residuals in a Fixed Income Portfolio

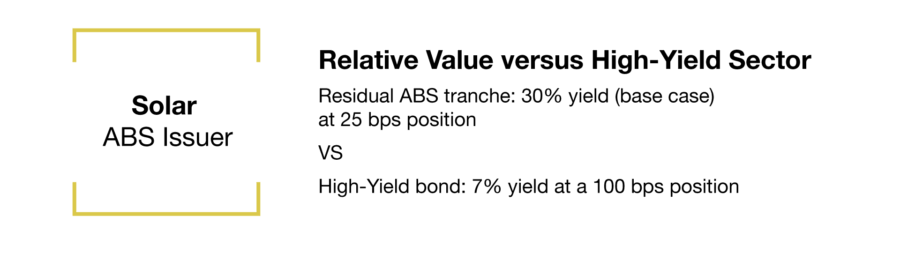

ABS residuals can be a great return enhancer and fundamental diversifier in a multi-sector portfolio that consists of more traditional forms of risk, such as government, corporate credit, and sovereign credit. It’s important to be mindful of the context in which residuals may serve in a portfolio. Given its equity-like risk/return profile, we believe residuals should be sized as a relatively small allocation. Just as important, ABS residuals can play an effective role in generating return while keeping portfolio risk constant. Below is an example of how this can be achieved:

Source: Thornburg

Here, we use the example of how to deploy 1% of capital in a portfolio. One option is to buy high yield at an approximately 7% yield. Let’s assume that the worst-case scenario is that the high yield positions default with a recovery rate of 50%, meaning a total 50 bps of loss to the portfolio. We strongly argue that in this environment, it’s better to construct the position with 25 bps in the ABS residual while deploying the other 75 bps in higher quality securities. This strategy results in the same yield but with lower capital at risk (25 bps, assuming 100% loss in default) and access to what we believe is a fundamentally stronger prime consumer balance sheet versus the corporate balance sheet.

The broader markets have experienced elevated volatility so far in 2022, and concurrent to this trend, base case IRRs for ABS residuals have been rising to compensate for greater macro uncertainty. That said, we continue to be very constructive on the ABS residuals we hold in our portfolios, particularly in deals backed by prime consumers. These borrowers exhibit strong credit and payment histories even in adverse economic environments. Despite potential macro driven price volatility, underlying cashflows look to remain fundamentally strong given the robust underlying borrower characteristics. While markets and our outlook on ABS residuals will continuously evolve based on changing fundamentals and valuations, we believe ABS residuals present a unique part of the broader fixed income opportunity set that investors should learn more about and perhaps implement in their portfolios.

Discover more about:

More Insights

When Geopolitics Drive Volatility: An Active Approach to the Iran Conflict

Thornburg Income Builder Opportunities Trust Announces Distribution

AI and the Increasing Instability of Global Relationships

Thornburg Income Builder Opportunities Trust To Host Annual Shareholders Meeting

Thornburg Expands Presence Across the Nordic Region with Boden Capital