The 60/40 portfolio remains a key strategy for achieving strong returns with lower volatility, underlining the importance of resilience and long-term investment.

The financial markets over the last year have left many investors feeling uneasy about their portfolios. With wild swings in stock prices and a challenging economic environment, it’s no surprise that some are beginning to question the traditional strategies that have guided them through years of investing. One such strategy is the 60/40 portfolio, a longstanding favorite among financial professionals and individual investors alike. As we reflect on the recent performance of this approach, it’s worth revisiting why it remains a cornerstone of sound financial planning and why it still has a place in your investment toolkit.

What is the 60/40 Portfolio?

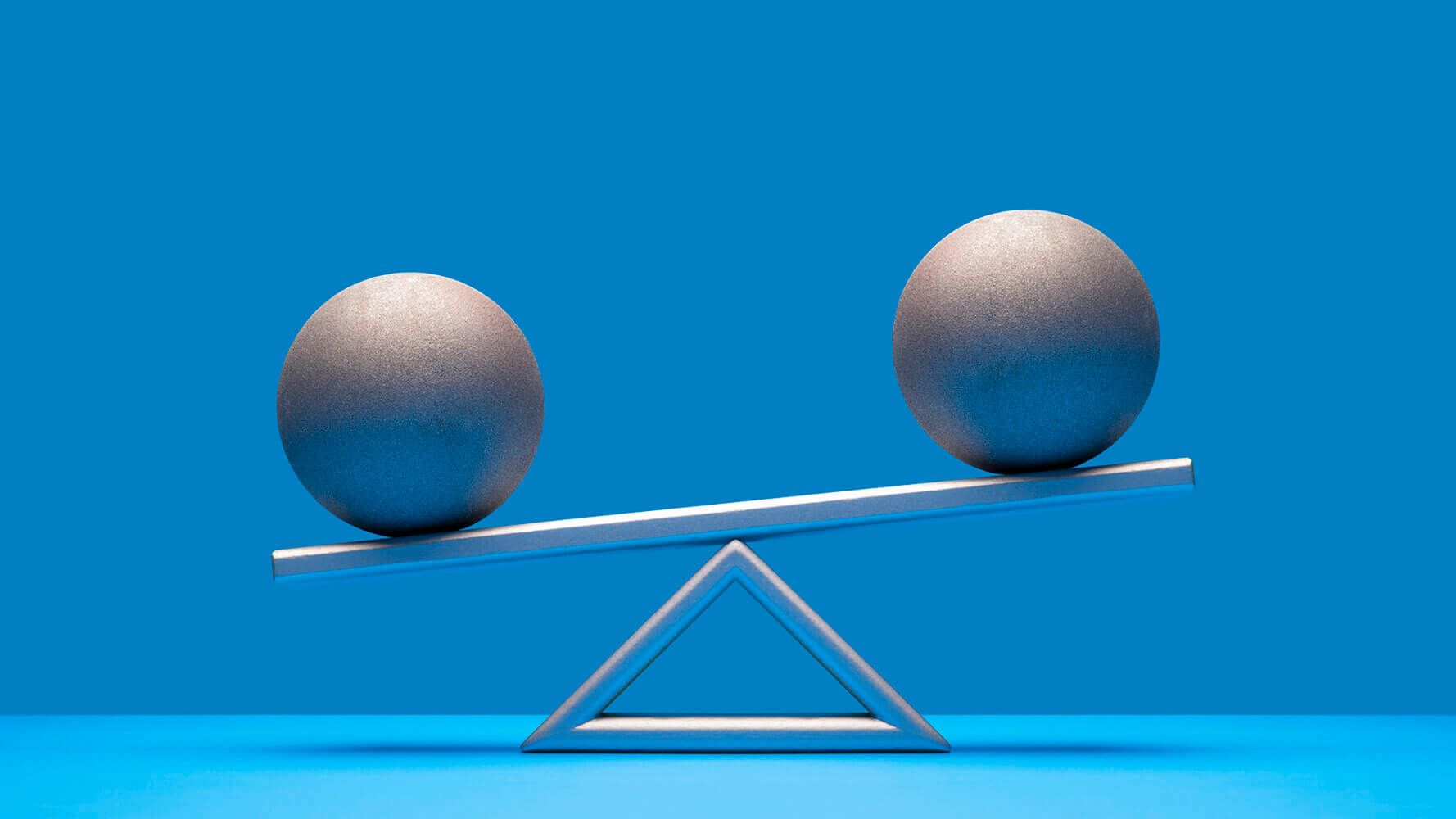

The 60/40 portfolio is a simple, diversified investment strategy where 60% of the portfolio is allocated to equities (stocks), and 40% is invested in fixed-income securities (bonds). This mix has been favored by both individual investors and institutional pension plans for decades due to its balance between risk and return. Historically, this strategy has delivered strong returns with relatively low volatility, making it a reliable option for long-term investors.

However, in 2022, this approach faced a significant test when it experienced a 17% decline. This performance shook investor confidence, and some were quick to declare the death of the 60/40 portfolio. But while the recent performance may have caused some to question its validity, it is important to recognize that this strategy has weathered many economic storms and continues to offer benefits for investors willing to stay the course.

Why Not a 50/50 or 70/30 Portfolio?

A common question that arises when discussing the 60/40 portfolio is: why this specific ratio? Why not allocate 50% to stocks and 50% to bonds, or even 70% to stocks and 30% to bonds? The answer lies in the research of Harry Markowitz, an economist who developed Modern Portfolio Theory. His work demonstrated that the most efficient portfolios are those that include assets whose price movements are negatively correlated, meaning that when one asset class falls in value, the other may rise or remain stable.

The 60/40 split strikes a balance between growth and stability, making it particularly effective for investors who want to manage risk while still seeking returns. Bonds offer a safety net in times of market turbulence, while equities provide the potential for higher growth over time. While it may be tempting to increase equity exposure to boost returns, doing so increases the risk of volatility and potential downside. On the other hand, a more conservative 50/50 split would likely result in lower returns over the long term. The 60/40 allocation has historically provided a sweet spot between risk and reward.

Should You Adjust Your Portfolio As You Age?

In years past, conventional wisdom suggested that investors should gradually reduce their exposure to equities and increase their bond holdings as they approach retirement. This was based on the assumption that retirees needed to preserve capital and reduce volatility in their portfolios. However, today’s retirement landscape is much different than it was a few decades ago.

People are living longer, which means retirees need their investments to continue growing to keep pace with inflation. Bonds, while typically more stable than stocks, do not offer the same potential for growth and may not keep up with rising costs over a 30- or 40-year retirement. Equities, on the other hand, have historically outpaced inflation over the long term. As a result, many financial professionals now recommend that retirees maintain a healthy allocation to stocks, even in their later years.

Reflecting on 2022: A Unique Year for the 60/40 Portfolio

The year 2022 was particularly challenging for the 60/40 portfolio due to a perfect storm of economic factors. Inflation reached its highest levels in 40 years, driven by pandemic-related stimulus measures and supply chain disruptions. To combat rising prices, the Federal Reserve raised interest rates 11 times over the course of the year, resulting in significant headwinds for both stocks and bonds.

The S&P 500 fell nearly 20% in 2022, while the Bloomberg US Aggregate Bond Index was down 13%, a rare occurrence of simultaneous declines in both asset classes. This unusual market environment led to the largest loss for the 60/40 portfolio since it began being tracked in 1937. However, it is important to remember that one year does not make a trend. In the 42 years between 1980 and 2022, the 60/40 portfolio was up 34 years, flat in two years, and down in only six years. This means that the strategy has delivered positive returns 81% of the time, a statistic that should give investors confidence in its resilience.

The Case for Staying Invested

One of the biggest mistakes investors make during periods of market volatility is trying to time the market. It can be tempting to pull out of investments when things look bleak, with the intention of getting back in when the market stabilizes. However, this approach often leads to missed opportunities, as it’s impossible to predict when the market will rebound.

The key to long-term investing success is to stay invested, even when the market is experiencing turbulence. The 60/40 portfolio, despite its recent challenges, offers a balanced approach that allows investors to weather periods of volatility while still capturing the growth potential of equities. It provides a steady framework that helps investors avoid the pitfalls of market timing and performance chasing, both of which can erode long-term returns.

The 60/40 Portfolio: A Time-Tested Strategy for the Long Haul

While the 60/40 portfolio may have been put to the test in recent years, it remains a tried-and-true strategy that can help investors achieve their financial goals over time. Its blend of growth and stability makes it suitable for a wide range of investors, from those just starting out to those approaching retirement.

Ultimately, the success of any investment strategy depends on an investor’s ability to stick with it through thick and thin. The 60/40 portfolio provides a solid foundation that allows investors to remain disciplined, avoid emotional decision-making, and stay focused on their long-term objectives. In today’s unpredictable market, that kind of consistency is more valuable than ever.

Discover more about:

More Insights

Key Principles of the ETF Execution Protocol

Finding Opportunity Amid Imbalance: 2026 Market Outlook

Thornburg Income Builder Opportunities Trust Announces Distribution

Will the Real Kevin Warsh Please Stand Up?

FOMC Update: Fed Holds Rates Steady After Three Successive Cuts