Investment Platform

Purpose-built for active investing

Investment strategies for the evolving needs of investors

Thornburg’s world-class investment platform enables our team to be nimble and decisive. Our investment processes, risk management and operational functions are in sync, enabling our team to see and capture opportunity differently and manage portfolios efficiently. We are committed to the integrity of our strategies at every point in the investment process and to sharing knowledge about our decisions with transparency and substance.

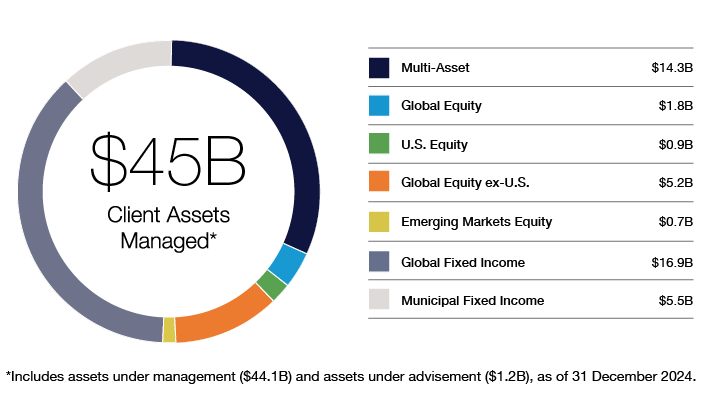

Today, our investment platform supports actively managed global equity, fixed income, multi-asset solutions and sustainable investments, as well as the communication and reporting requirements for diverse investors.

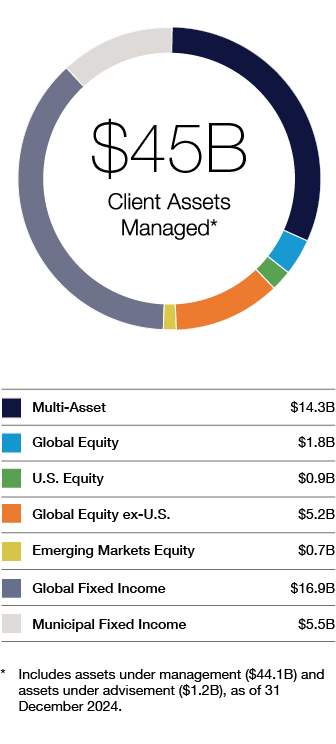

Assets Under Management

Investment Vehicle

- Institutional Separate Accounts

- Mutual Funds

- Retail Managed Accounts

- UCITS Funds

- Collective Investment Trust (CIT)

- Closed-End Funds

Locations

Americas | EMEA | Asia-Pacific

Santa Fe, NM · Hong Kong

The PRI is the world's leading proponent of responsible investment. It works to understand the investment implications of environmental, social and governance (ESG) factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

Philosophy

A way of seeing

For four decades, the pursuit of consistent risk-adjusted outperformance has shaped Thornburg’s character and culture. Our professionals are eager to pursue investment outcomes beyond the confines of an asset class or popular wisdom. We are a free-thinking and independent asset manager who connects ideas and intelligence from across strategies to pinpoint market signals—our way of seeing is different. We have steadily expanded our capabilities to serve the evolving needs of investors and exploit opportunities in changing markets.

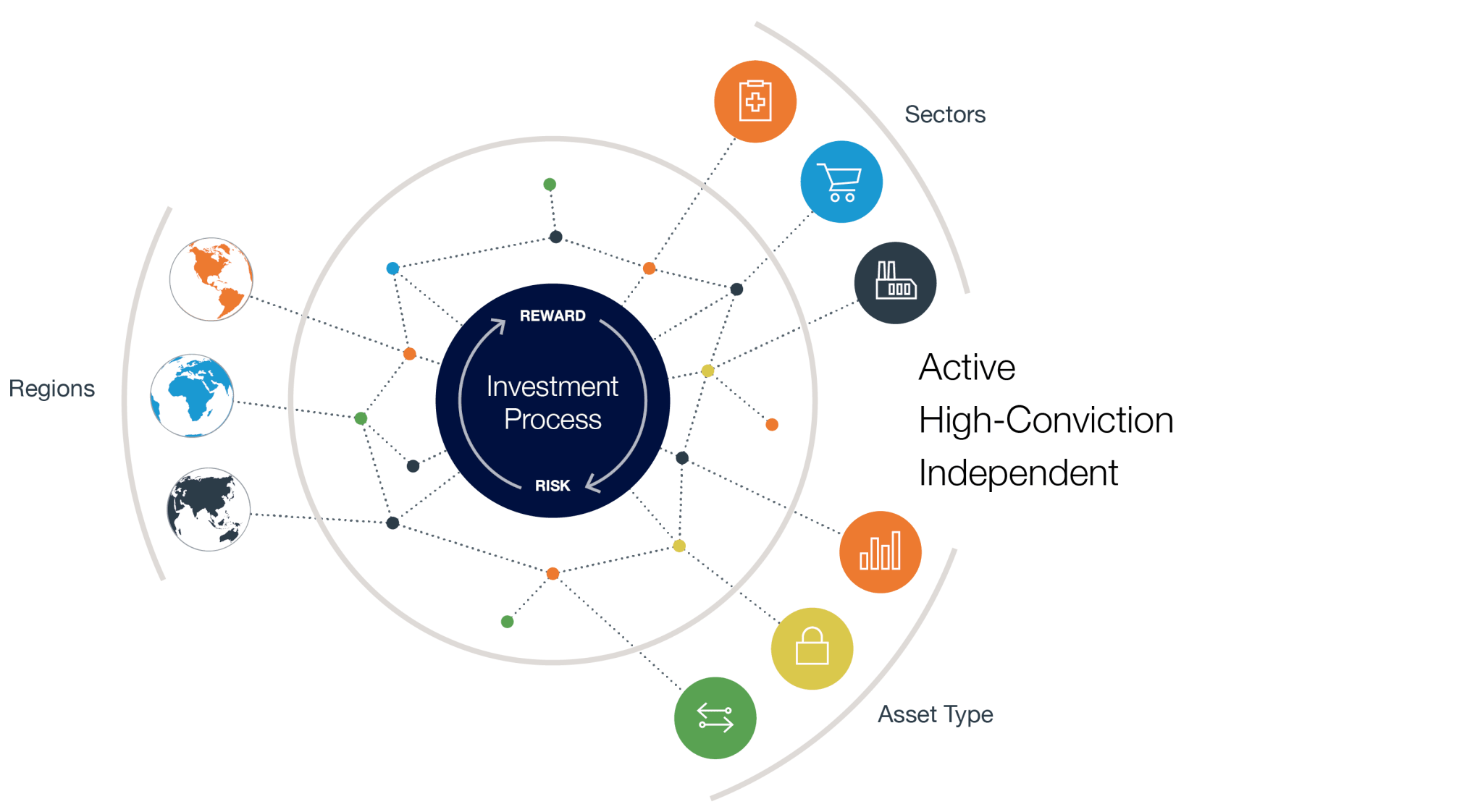

Investment Approach

In pursuit of investment truth

Thornburg’s team brings holistic expertise across geographies, sectors and asset classes to the investment process. It is an iterative approach, where continual and open communication among portfolio managers and research is expected. This is how ideas evolve into investment theses and where validation begins to uncover investment truth. We employ a full complement of fundamental analysis and other proprietary research techniques to evaluate an individual investment. Each idea is debated from multiple viewpoints and where it sits in a complex and interconnected global market. A high-conviction position is a decision we make together.

Sustainable Investing Philosophy

We believe that environmental, social and governance (ESG) issues influence investment risk and return and, therefore, our ESG approach incorporates ESG factors that we believe materially impact the investment outcome within our proprietary fundamental investment process.

Assess Material ESG Factors

We seek a deep understanding of financially material ESG factors and their integration into the risk and return framework.

We utilize a mosaic of sources, including the company’s primary materials, engagement with management teams, and/or independent third-party analysis.

Manage Stewardship Plan

As active managers we use a variety of tools in our stewardship practices, from direct engagement to using our voice in proxy voting.

We focus on constructive dialogue with companies, believing that building trust allows us to achieve the most productive change.

Risk Management

Oversight at all levels

Risk management is a multi-faceted question. We look across the functions of our firm on a systematic basis to ensure that our investment process, trade functions, accounting and reporting protocols, and operations and technology integrate high standards of risk management.

Within our portfolios, risk is managed through a combination of qualitative portfolio manager peer review and quantitative techniques, providing robust data on factor exposures, credit, interest rates and volatility metrics. Investment risk is analyzed through intensive, bottom-up fundamental analysis and valuation for individual investments.

Portfolio and risk management