Bank loans are a go-to tactical investment in anticipation of monetary tightening. The problem: Investors have a poor track record timing the market.

Many Investors Just Aren’t Timing It Right with Bank Loan Funds.

Investors often take a complicated route toward investment opportunities when simple solutions are readily available. When applied to the already complex world of fixed income, the results are often disappointing.

Take bank loan strategies. Bank loans have represented a go-to strategy for investors who anticipate monetary tightening. They have been used as a tactical investment often meant to defend against upward rate movements, while at the same time taking advantage of some of the potential benefits of high-yield credit.

In theory, these investments not only provide elevated income but could also avoid the interest rate risk of fixed-rate bonds (bond prices and yields move in inverse directions). This seemed like a good deal to most in 2018 as the Federal Reserve was in tightening mode and increasing short-term rates.

By carving out a tactical, direct allocation to the asset class, investors were ultimately taking on the responsibility of timing both rate and credit conditions. The problem: investors may not be equipped to adjust their portfolios quickly enough to the market’s dynamics.

Volatility in Bank Loan Funds

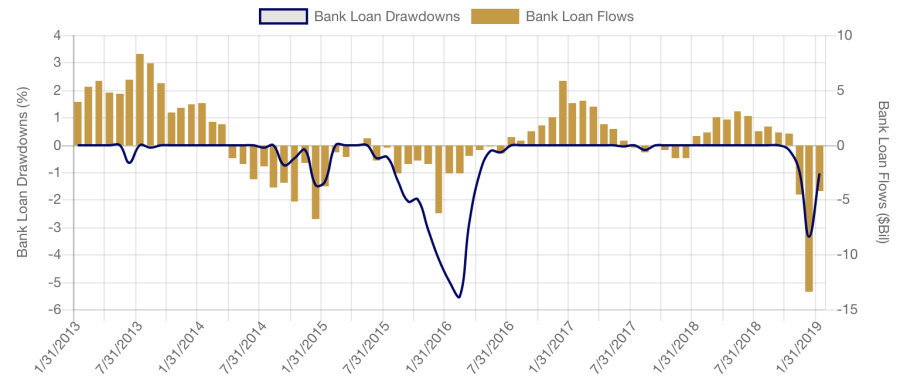

The challenge investors face with “timing” their bank loan investments is illustrated in historically volatile bank loan flows and the swift periodic drawdowns investors have experienced. The past five years serve as a marked example. While 2016 was the most painful in that period, previous years also showed meaningful drawdowns and volatile flows.

U.S. bank loan category flows chart (1/31/2013–1/31/2019)

Source: Morningstar

*Morningstar US Fund Bank Loan Category

** A drawdown is a peak-to-trough price decline of an investment.

Most recently, in 2018, concern about rate increases by the Federal Reserve prompted investors to pour into bank loan funds steadily—creating a boom that captured bond market headlines. But tides turned quickly and outflows increased dramatically as the bond market signaled a possible end to the year’s rise in rates. Investors in bank loan vehicles experienced a drawdown of over 300 bps from September to December as volatility increased, wiping out nearly a year of income in a short period.

History shows that investors run the real risk of experiencing painful whiplash, contradicting the purpose of tactical bank loan allocations—improving investment outcomes. Investors may want to consider simpler methods of gaining floating rate exposure that do not require market timing on their part.

Balance the Risks and Rewards with a Multisector Approach

To take advantage of potential benefits of bank loans, and capitalize on other opportunities, investors may consider an actively managed multisector fixed income strategy. In particular, investors may consider a manager of a multisector strategy that evaluates securities on an individual basis and, relative to other available opportunities, can provide exposure to select bank loans when their risk-adjusted returns appear most compelling.

Multisector managers can focus on producing compelling risk-adjusted returns with a complete menu of fixed income asset classes, so they have the potential to generate more consistent risk-adjusted returns than a single asset class while effectively taking on the timing challenge for investors.

By choosing an actively managed multisector strategy, with a long-term track record of adding value, rather than betting on a single asset class, investors can streamline their bond portfolio and avoid potential tactical missteps.

Discover more about:

More Insights

Will Closing the Korea Discount Create Investment Opportunities?

Why Is There a Korea Discount?

The ABCs of Personal Finance

How to Position Bond Portfolios as the Fed Ponders a Pivot

Creating a Winning NCAA Basketball Tournament Bracket is More Challenging Than Successfully Selecting Stocks